LIFE-STAGE PLANNING

We help our clients build and execute a financial plan focused on achieving their most important goals and dreams at every stage of their lives.

RISK MANAGEMENT

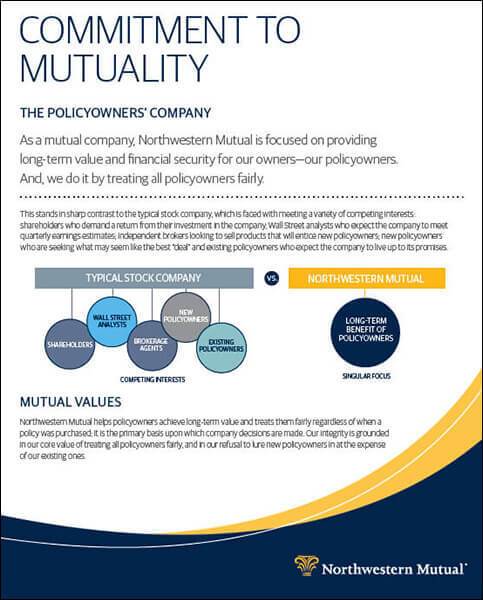

We understand that while risk cannot be eliminated, it can and should be mitigated. A comprehensive plan must consider and prepare for the unexpected – such as accidents, illness and disability. Our team helps you think ahead and consider alternative scenarios, then prepare contingency plans to solve for adverse situations that could set you and your family back. We evaluate risk management strategies, and as needed, recommend necessary solutions for life, disability, and long term care. We have access to world-class risk management products to serve both business enterprises and high net worth individuals and families. Northwestern Mutual offers its advisors access to an exclusive product line designed on the following principles: Commitment to Mutuality.

WEALTH ACCUMULATION

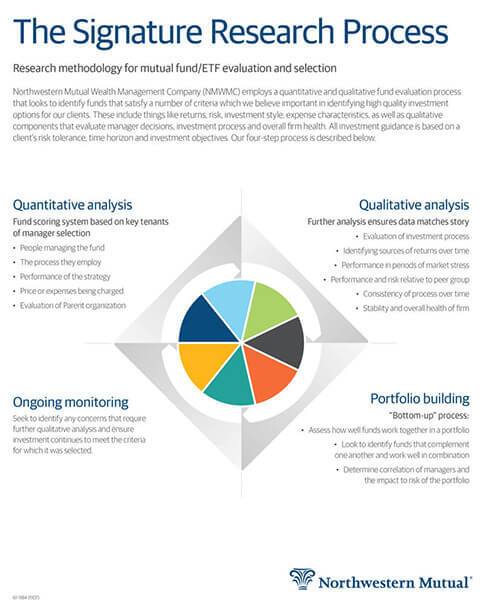

OUR INVESTMENT ADVISORY PROCESS

Here at Pioneer Financial we appreciate that careful planning today is essential to reach your goals for tomorrow. Our advisor team understands the complexity of issues faced by individuals like you and the importance of following a sound process. We will act in your best interest by following a comprehensive process not just at the time of sale, but throughout your relationship, working with you to meet your long-term goals.

- Identify Goals – We will guide you through a comprehensive fact-finding process that will help determine your time horizon, potential income needs, risk tolerance, and your attitudes toward investing.

- Create Personalized Investment Policy Statement – Based on the information gained from your financial profile, our team will recommend an appropriate asset allocation strategy. This strategy is formalized through an Investment Policy Statement that helps provide the discipline to follow your investment plan and make decisions free from emotion.

- Select Investments – Choose from a wide variety of investment options such as mutual funds, exchange-traded funds, stocks, and fixed income securities to complete your asset allocation based on the advisory program chosen.

- Review and Monitor – Advanced account servicing tools help your advisor analyze whether your account remains in line with your Investment Policy Statement. Our Team will meet with you periodically to review any significant changes to your personal or financial situation and help determine whether these changes will require any repositioning of your portfolio.

WEALTH PRESERVATION

The more assets you accumulate, the more complex the task of preserving and protecting them.

Success cannot be achieved without hard work, discipline, and a long-term focus. We believe this also holds true in the management of one’s assets. We manage assets with the same values and common sense that you have used to create your wealth over your lifetime.

We are uniquely qualified to take on the duties of asset management and/or trusteeship for you. Through a Northwestern Mutual Wealth Management Company investment management or trust account, you can leverage the expertise of a trusted partner who offers a suite of trust and private client services designed to address your unique wealth and estate management needs.

Our advisor team plays a vital role in the ongoing servicing of your accounts and will remain your primary point of contact. On questions or issues that require additional resources to address, your wealth management advisor will have direct access to your account’s dedicated account administrator, as well as the investment team responsible for the ongoing management of your assets.

We provide comprehensive solutions for individuals and enterprises with a level of personal service and continuity that is rare in an age of bank mergers and consolidations.

FOR MORE INFORMATION ABOUT OUR ADVISORY PROGRAM PLEASE CLICK ON THE SIGNATURE RESEARCH PROCESS BROCHURE ABOVE.

HOW A TRUST CAN HELP YOU?

Distribute assets according to your wishes. There is a common misperception that trusts are only for extremely wealthy individuals, who use them to avoid paying estate taxes. While tax considerations often play a role in estate planning, people also use trusts to provide themselves with a greater level of control over the management and distribution of their estate after they’re gone. Although the trustee legally owns the assets, they are managed and distributed according to the terms of the trust agreement. As the grantor, you set those terms when the trust is established.

Preserve wealth by potentially reducing or eliminating estate taxes. A properly structured trust* may be used to potentially postpone, reduce or eliminate estate taxes, which – if not appropriately planned for – can claim a significant portion of a large estate.

Support your spouse, children and grandchildren. As grantor, you may choose to specify that after your death, your spouse should receive a lifetime income stream from the trust. Your spouse may also receive distributions of principal. At your spouse’s death, the remaining assets may then pass to your children, grandchildren or others you designate.

Reduce capital gains taxes while supporting charitable causes. Donating highly appreciated assets to a Charitable Remainder Trust is an example of a potentially powerful charitable giving strategy. The trust is able to sell the assets and defer the capital gains taxes. It can then acquire income-producing investments (with the full, tax-deferred proceeds from the sale) to provide you with a stream of income for your life. At your death (or that of your spouse), the remaining assets pass to the specified charity (or charities) you chose, fulfilling your charitable intentions.

Keep your business in the family. Without proper planning, family businesses are often sold at the death of the owner (or the surviving spouse) to pay estate taxes. One possible solution is to create an Irrevocable Life Insurance Trust that holds an insurance policy on your life. At your death, the proceeds from the policy are used to lend money to your estate so it has the liquidity to pay estate taxes without having to sell off part or all of the business. This may allow the business to continue operating under the control of a future generation.

Avoid probate and ensure financial privacy. Probate is the legal process of settling an estate. It can be an expensive, time-consuming and very public process. A trust, however, is a strictly private arrangement that permits you to accomplish your goal of transferring your estate as you intend.

Pioneer Financial and Northwestern Mutual Wealth Management Company have the resources and expertise to provide all the necessary services required to support a variety of revocable and irrevocable trust types, including (but not limited to):

- Revocable Living Trusts

- Testamentary Trusts

- Irrevocable Life Insurance Trusts (ILITs)

- Charitable Remainder and Lead Trusts

- Generation-Skipping Trusts

- Grantor-Retained Trusts

- Marital and Unified Credit Trusts

We offer a variety of flexible trustee arrangements that suit your evolving needs, whether we serve as your trustee, co-trustee or personal representative (executor).

*PIONEER FINANCIAL AND NORTHWESTERN MUTUAL WEALTH MANAGEMENT COMPANY DO NOT PREPARE TRUST DOCUMENTS OR PROVIDE ANY EXPLICIT OR IMPLICIT GUARANTEE OF A GIVEN TRUST’S ABILITY TO MEET THE OBJECTIVES OF THE GRANTOR (OR OTHER PARTIES TO THE TRUST). ANY INDIVIDUAL CONSIDERING THE CREATION OF A TRUST SHOULD SEEK ADVICE FROM QUALIFIED LEGAL COUNSEL. PIONEER FINANCIAL AND NORTHWESTERN MUTUAL WEALTH MANAGEMENT COMPANY DO NOT OFFER SPECIFIC TAX ADVICE AND CLIENTS SHOULD SEEK ADVICE FROM THEIR SPECIFIC TAX ADVISOR.